The Fintech industry is positively going through a rapid change. The upgrade is meant for the financial partners and their clients. The overall goal is to help users in managing their finances and prevent cyber risk.

If we talk about the fintech industry, we can fairly examine that the pandemic year has proven to be a life-challenging experience for the industry. The crisis forced every business and consumer to rely on digital services. For financial technology or Fintech, this results in positive growth, as everyone is using the services more than before. The demand creates a powerful impact on the industry and creates opportunities to flourish in 2021.

The service is an eminent combination of financial benefits and technology that is tremendously changing the way businesses operate. Over the past, we have observed different fintech app development services which are adding up each year. Fintech applications like Online banking apps, Insuretech, Regtech etc. are becoming popular. As it is not just a flash in the pan, the fintech industry is gaining importance.

Fintech Industry Overview:

1) A great number of banks, financial institutes and investment companies are expected to connect with the technology. In addition, we can positively see around 20% return on investment over the next 3-5 years.

2) With the help of advancement, the fintech companies are providing low-cost custom products that impress the users, and also create pressure on traditional companies to use innovation.

3) APIs and other advanced tools like chatbots, Disturbed Ledger Technology (DLT), Robotic Process Automation (RPA) and many more are making the process easy, effective and expedite for the users.

Fintech Industry Market Trends in 2021:

The popularity of fintech products has immensely grown and every financial startup is required to include fintech product development in their business model. You cannot assume a modern-day financial service without proper mobile app design and development. Moreover, with the well-developed competitive market, the industry is mainly focusing on payment technology and retail banking.

Besides, healthcare and other industries are utilizing innovation to optimize their business module. With the help of technology and advancement, there are opportunities for every business to win the market.

In 2021, there are some specific key areas to look out:

1) Online Banking (Mobile Banking Apps):

The modernization has facilitated people to reduce their bank visits, and manage most of their financial activities from home using their mobile devices. Thanks to Artificial Intelligence, Biometric technology, Cybersecurity and other advanced tools to make online banking more reliable for users. All these tools together create a secure environment so that users can trust the system.

The system is going paperless as we can notice a wide decline in offline banking procedures. Moreover, for any issues or queries, users can contact the bank using online messaging and chatbots; the facility has created a comfortable room for people. With time, banks are introducing more services to the online platform to help users with a hassle-free banking experience. Internet banking apps are an imperative element to watch out for in 2021.

Apart from online banking, mobile-only banking apps are getting into the greater picture.

2) Contactless Payment Apps:

If we look back, there are many payment apps that were welcomed and favoured by many people worldwide. These are different services than the online banking apps (somewhere connected with banking), which are used to send and accept payments. It is more likely an online wallet to pay bills and manage other finances. PayPal is a renowned name when we mention contactless payments; it even allows us to send international payments, fast and securely.

Similarly, services like Apple Pay, M-Pesa by Vodafone and many others are assisting users with contactless payments. The market is open and we can see much more in this category, this year.

3) Biometric System For Security:

With the introduction of Fintech apps, every user can manage it’s banking and financial needs using its mobile device. With the growing fintech mobile applications, the risk of user security also increases. Mobile banking apps and other financial services are already using several security measures to keep users’ data secure. However, there is a long way to go. Currently, the fingerprint biometric system is termed to be the safest of all; though it requires physical contact with the device.

Despite the surge of physical biometric security systems, it is assumed that it will be replaced by contactless biometric technology. That means contactless solutions will certainly diminish touch-based verification systems in the near future.

4) Fintech literacy and solutions:

It is integral for users to be financially literate so that they can understand how to precisely spend their savings. As per reports, on average, an American family has around USD 8500 in their bank or credit union savings. Whereas singles have fewer savings. Generally, to improve savings, consumers need a financial tracker. These helpful fintech tools certainly support them to learn finance which will positively result in improvement.

Besides, these tools can assist them to know any credit card or bank loan hidden charges. The goal is to educate users about the different financial charges, so they can spend wisely and save accordingly.

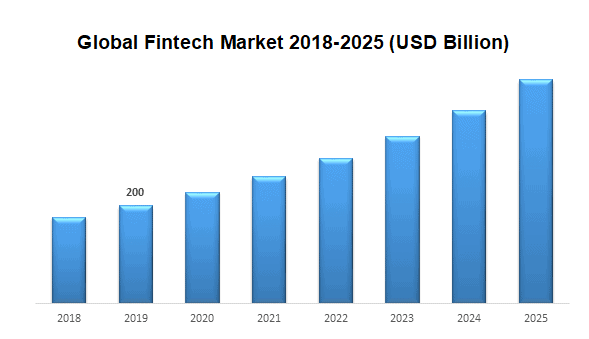

Conclusion: Fintech Market Forecast

The pandemic has made us aware of the importance of technology.; it is the only way that businesses survived during the tough time. Now, as we are moving to complete the first half of 2021, the future will certainly bring challenges and opportunities for the fintech industry.

As we already learnt from this blog, the industry will be healthy for the banking and retail sector. Positively, we can see more startups and companies adopting digital platforms to expand their services.

Also read: 8 Industries where App Development can play a major role in Digital Transformation

Looking for an experienced mobile app development company in the USA?

Grey Chain is a top mobile app development company operating from the US and India. With extensive experience in web and mobile app development, we facilitate our clients with advanced tools and technology.

We work closely with our partners to dispense valuable services. We have a specialized team of fintech app developers that assist with custom fintech product development.

To know more, contact our team using the app consultation form.

We are looking forward to assisting you!

Get in Touch

Get in Touch